I believe that everyone should be investing their savings in the market. Arguably, it is the safest way to grow your savings, even safer than real-estate, provided that you know what you are doing. You don’t have to be a financial expert or a stock broker to do relatively well.

Open a Brokerage Account

Before you can start investing, the first thing you should do is open a brokerage account. There are many options available and sometimes the easiest way to do this is through your bank. For instance, Chase and Bank of America both offer brokerage accounts and it could be as simple as meeting with a banker to open one. Other non-bank options includes Fidelity and Robinhood.

It is important to be mindful of the fees associated with each trade which is the buying and selling of stock. Chase and Robinhood offer no commission trades. Fidelity and Bank of America charge a fee for each trade.

Another aspect to consider is whether the account is FDIC insured. If an account is FDIC insured, it means that you will not lose your money if the bank or institution goes under. Although Chase and Robinhood has no commission trading, they are not currently FDIC insured whereas Fidelity is.

Pick an Investment

The short answer is go with an index fund. As I have explained in How to Get Rich Gradually by Investing, Index funds are by definition diversified and there are many to chose from. The most popular of which is the Vanguard 500. But before you simply pick that one, it is important to understand the different types of investments and the risks associated with them. If you are just starting out, never invest in stocks if you do not know what you are doing.

Types of Investments

Here are a list of investments ranked from least risky to most risky. The risk factor can vary greatly between different investments. Risk and reward go hand-in-hand and you can typically gauge how risky an investment is by how much you could potentially earn. Below I am expressing risk and rewards as a typical rate of return or loss that one could expect from that type of investment per year.

- Bonds – Arguably the least risky investment. Bonds are a fixed-income investment that represents a loan by a corporation or government.

- Typical Return/Risk: 1-4%

- Index Funds – A fund that is made up of a particular market which is tracked by a market index. By definition these are diversified as these funds are made up of shares in multiple companies.

- Typical Return/Risk: 4-15%

- Mutual Funds – These are actively managed funds. They are popular among investors yet most actively managed funds cannot beat the S&P 500 market index.

- Typical Return/Risk: 3-10%

- Exchange Traded Fund (ETFs) – This is typically a basket of investments rolled into one. The could be made up of funds or stocks. They typically carry the same risk as stocks or funds.

- Typical Return/Risk: 3-30%

- Stocks – These are shares in a single company. Some are safer than others and can vary drastically.

- Typical Return/Risk: 5-30%

- Typical Return/Risk: 5-30%

- Options – These aren’t stocks or funds themselves, rather they are are a contract that allows the buyer to buy or sell a stock at a certain price. This is essentially just gambling since in order for you to profit, someone else has to lose money. Unless you are a seasoned day trader, stay away from these!

- Typical Return/Risk: 5-100%

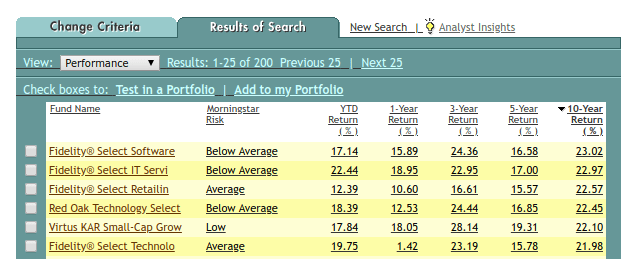

Research Funds using Morning Star

A tool that I always use when picking a fund is Morning Star’s Fund Screener. It is an extremely powerful tool that gives you performance history of any fund you are thinking of investing in and many investors use this website to determine which fund to invest in.

You first have to make an account. When you login, click More > Tools > Basic Fund Screener. For the best results, I usually change, “Morning Star Risk better than or equal to: Average” and in the results view I view by performance and sort by 10 year return % and pick the highest one with the least amount of risk. See screenshot below:

Long Term Strategy: Buy and Hold

When ever you make an investment, you want to hold it for as long as possible. This is how the wealthy stay wealthy. Here are my personal guidelines that I follow when I invest for the long term:

- Invest in a fund with a long history of high returns and average to low risk

- Buy and hold for at least 6 years

- Don’t panic and sell if it goes down, just wait it out

- Periodically invest monthly

- Don’t sell unless you have to, if you do, only sell what you need

When investing in index funds or mutual funds, you do not have to check on them every day, you can pretty much just invest and forget about it and only check maybe once every 3 months.

Learn the Basics

In order to be truly effective at investing, I highly recommend picking up a book that covers the basics of investing. The book I recommend to all my friends or to anyone who wants to grow their savings by investing is, The Motley Fool Investment Guide.

This book covers all the things that every investor needs to know, like what the S&P 500 or the Dow Jones is. It also really gets you into the right mindset when it comes to long term investing and most importantly of all, covers the common mistakes that beginners typically make. It was this book that taught me that by simply investing in index funds like the Vanguard 500, you will beat more than 75% of investors out there. It is filled with common sense strategies like that one.

Start Investing Right Now!

If your money is just sitting in a savings account, it won’t grow with inflation so start investing as soon as possible. Put it on your calendar, and make an appointment with a banker to open up a brokerage account or at least shop around for the best one. Pick one fund that is low risk with high returns from Morning Star or simply go with the Vanguard 500 Index Fund and your investment will grow with the US Market. Put an initial investment of whatever you can spare and setup a monthly investment of at least $50. When you check back in 1 year, you will be surprised at how much it has grown!