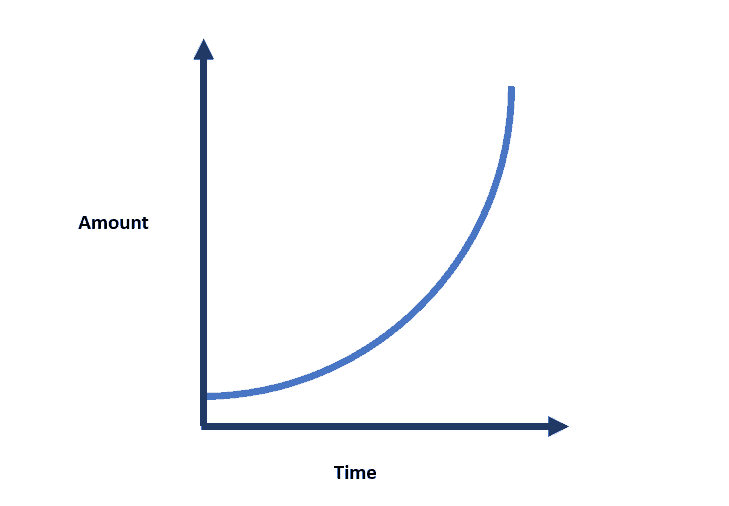

Interest, when investing, it can make you rich over time. When it comes to debt, interest can inflate the amount you owe several times over. Understanding interest could mean the difference between financial security or financial ruin. If you forgot everything you learned in middle school math, at least remember this, interest grows exponentially.

eg. f(x) = a * (b^x)

Now even if your investments only grow by about 5% each year, it still grows exponentially and this can really add up. This graph would still look the same if it were still only 5%.

Investment Interest

This is the easiest to understand. If you recall the formula above, it is basically no different. Here’s what the formula means in terms of investments.

amount = (initial investment) * ((1.00 + interest) ^ years)

Where interest is expressed in terms of a percent. eg. 0.07 or 7%.

Now let’s say we invested $100 over 10 years. Assuming it grew consistently at 7% every year, that amount would be $197!

$1,050 = ($100) ^ ((1.00 + 0.07) * 10 years)

Now imagine that was $10,000, it would grow to $19,700. That’s basically doubling your money from the initial investment for basically doing nothing and that is not even including additional investments made every month. This all happened over a mere 7%!

Debt Interest

Debt interest works a little differently because you are constantly paying it off. There is not simple formula for calculating this but fortunately there are many mortgage and loan calculators out there.

To see how quickly debt can add up and how much it can add to the total cost of a purchase, let’s look at a mortgage example.

Suppose you want to buy a house that costs $500,000. You put 20% down and you need to take out 30 year fixed mortgage at 4% APR. This means that every year your outstanding debt grows by only 4%. That doesn’t seem like much right?

Well if we do the calculation using Google’s Mortgage calculator, we can see that:

- Your principle payment will be: $1,910 per month and the

- Total cost of your house will be: $687,478! That’s $187,000 more than the original price of the house!

Let’s say that your neighbor, who earns double what you make, decides to buy the same house but opts for a 15 year fixed mortgage:

- His principal monthly payment will be: $2,959 but

- The total cost of the home is: $532,575 which is only $32,000 more than the original price of the home and he would have paid for it in half the time!

Of course, you can do this same calculation for car payments as well. If you ignore the significance of interest, you could be paying way more something than it is actually worth.